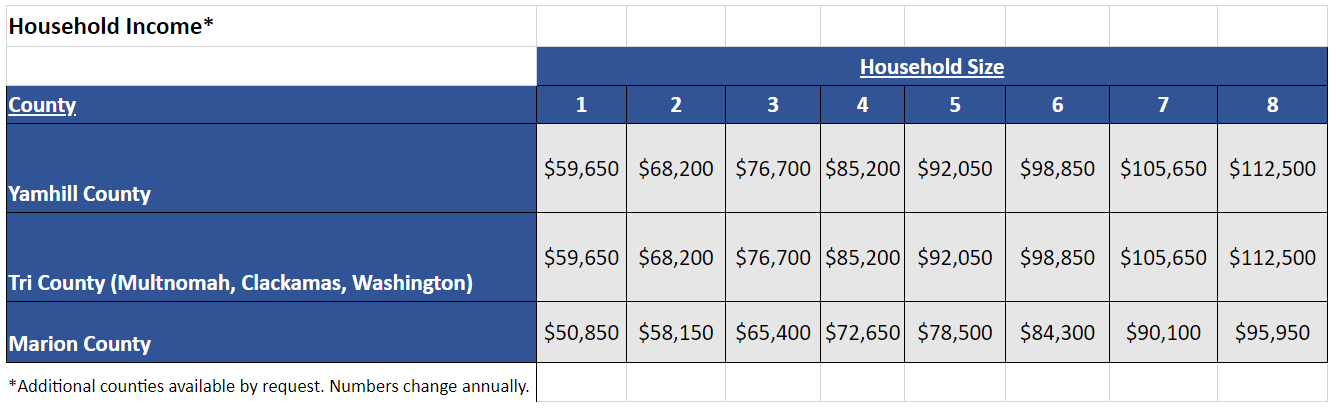

Use the below chart and example to help answer the next question:

1. First, determine the number of people in the tax household (includes anybody you file taxes with like your spouse and dependent children)

2. Second, find your County on the left.

3. Third, consult last year's tax return(s) for the gross income of all earners.

For example:

1) I have 2 adults and 2 children in my tax household (myself, my spouse, and our 2 kids that I include when I file taxes)

2) I live in Yamhill County.

3) My spouse and I listed $60,500 for our yearly income.

I would choose 'Less Than' in the below question as my income is less than $85,200 for a house of 4 in Yamhill County.